We all know there is no “one-size-fits-all” marketing (that would be too easy). You adjust your approach by country, right?

But in the US, would you market your institution the same way in Southern California and Texas? How about in Brooklyn?

Turns out, China is a big country too (surprise). And in a huge market like China, there can be a temptation to lower your strategic standards and provide the same marketing material to every prospective Chinese student. We’ve talked about segmentation often. To get the right students to your campus, you have to focus on niche markets with the right messaging.

Segmentation is especially important to small institutions with no brand recognition abroad. So, today we are talking about China’s second and third tier cities, and how you can leverage your brand in these harder to get to places. (Actually, many of them are on high speed rail and have reasonable flight schedules now.)

Bottom Line: Segmentation ensures that the right information gets to the right audience. In China, the criteria for a destination country varies depending on student academic interest. Additionally, a student’s academic level impacts the type of information they desire. Finding the right Chinese students for your campus involves tailoring information to targets and strengthening your relationship with agents. Agent management systems that reward success are essential to finding the right students and maintaining your institution’s reputation.

In 2014, Kim Morrison, CEO of Grok Education Services and Lakshmi Iyer, Education Sector Head for Sannam S4 teamed up to give a great presentation at the AIEA conference and Intead was there to soak up all that data. According to Kim, institutions moving beyond just grabbing all the international students they can find (she calls them “second generation” institutions) are working on “refining their recruitment outcomes.” She’s talking about getting best fit students. You can find the slides here.

What do Chinese students want from their study abroad?

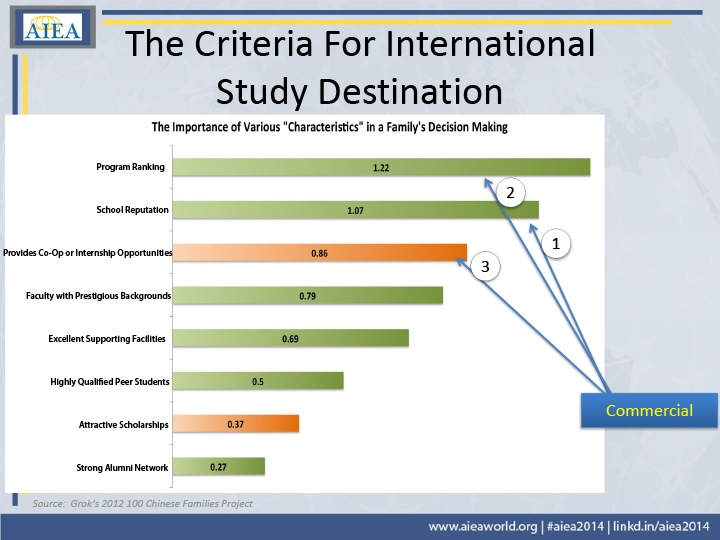

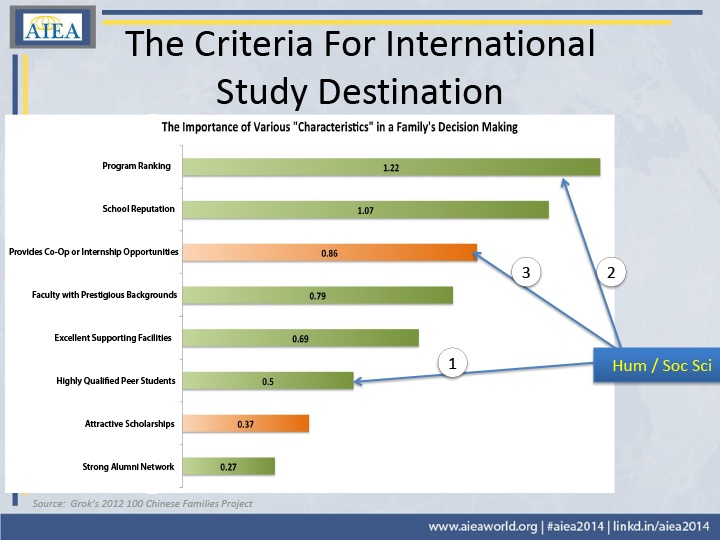

According to Kim’s presentation, Chinese students are increasingly diverse in their needs. For example, while families have similar desires for international study destinations, the importance of those desires may depend on the students’ area of study. As families are making decisions together, they are looking at school reputation, program ranking, and co-op or internship opportunities as their primary criteria, in that order. See charts below.

In contrast, those seeking a degree in social sciences tend to prioritize their criteria differently with highly qualified peer students being their most important influencer followed by program ranking and then co-op or internship opportunities.

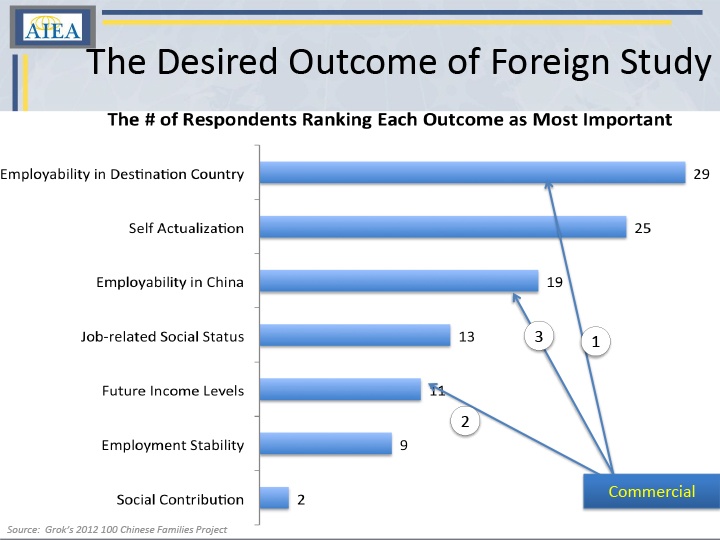

Kim also explains that students in certain areas of study have different desired outcomes from their investing in higher education. Students choosing commercial studies were most interested in employability in their destination country, while humanities students were more concerned with employment stability.

How can you tailor content in China?

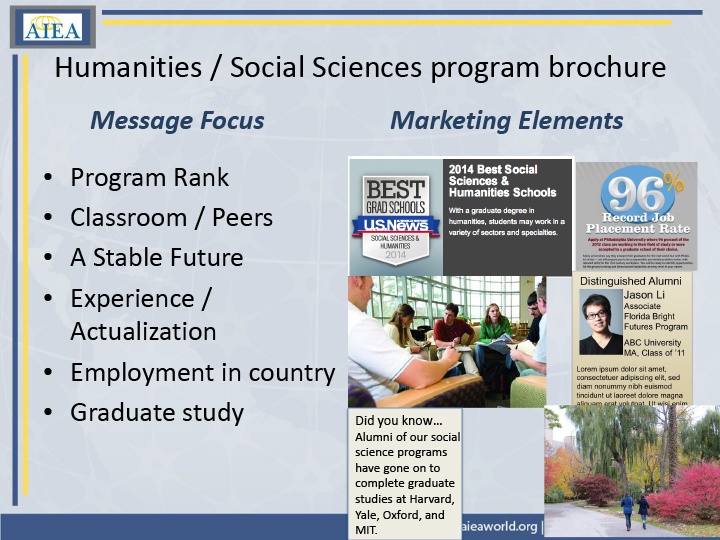

Segmentation can be implemented in your marketing materials on or offline. Kim shared the following list of message options that a brochure for a humanities/social sciences program might contain.

How else can you focus your tactics to ensure you are attracting the students you want? Form partnerships with high schools and universities and build your brand in the desired academic area with specialized campaigns.

Initiate programs that are “on brand.” If you are interested in increasing STEM enrollment, technology competitions and science summer camps will help solidify the connection prospective international students make between science and your institution (even if they don't come, they will see your promotions of these events).

It is also wise to acknowledge the regional differences in China. Morrison suggests that those from primary cities are more likely to study social sciences and those from secondary are slightly more likely to study in the STEM fields. This is an interesting finding and we’d welcome your comments to see if you are finding similar trends.

What other tactics can you use to increase quality enrollment?

Deepen your agent tracking and management by tracking student outcomes over time and reward agents who conform to your standards (provide students who actually fit your campus). This can be tough in first tier cities because the agents working there want to work with top tier institutions. The further you travel outside these primary markets, the more agents you will find willing to work hard for you.

When you target quality leads, retention increases, student satisfaction rises, classroom experiences improve, faculty is more content and your rank is maintained. Extra work for a better result.

China’s tier one cities include Shanghai, Beijing and Guangzhou. This is where big schools with well-known programs (think US News top 100) are recruiting students by just showing up. Don’t go there.

Some of the most populous and diverse tier two cities include: Chongqing (~49 million people), Tianjin (~15.5 million people), Chengdu (~14.5 million people), and Suzhou (~10.5 million people). Clearly, these cities are worth your time and attention, and the market is less saturated with big American names. There are also many third tier cities in the wealthy Jiangsu province that are worth considering for your student recruiting. Their proximity to Shanghai is a draw for talented students and young professionals. Easy to get to, as well.

Segmentation can go a long way in your recruiting here. Stay competitive in this market by providing students with the messaging that will attract their attention and the specific information that will help them make smart decisions for their futures.

We suggest you take a stroll through Kim and Lakshmi’s slides from the 2014 AIEA (link above).

Does your institution have experience with niche markets in China? Tell us about it in the comments.