Universities are looking for future revenue streams. Couldn't universities invest in the future of their students and secure their own future? How would that work?

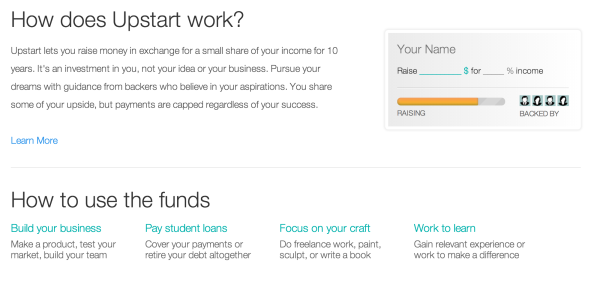

Students take on jobs which don't advance their education or add relevant experience. Couldn't universities provide part of the funding for their students' education -- based on the future earnings from their alumni? Does this idea sound crazy? A company, called www.upstart.com is doing exactly that.You raise money based on your future earning potential and you guarantee a certain percentage of your income to the funders, let's say 1% of your income over a 10 year period.

Source: www.upstart.com

Let's look at this model and how this type of funding could supplement the current system for American and possibly international students. To pay for college in the U.S., each student raises money from their families, takes on student loans guaranteed by the government or borrows on their credit card. Income-based repayment has become the basis for part of the newly issued U.S. government-guaranteed student loans as well. It seems a fair way for our society to spread the risk of education -- and universities would have a built in portfolio effect-- the MBA or computer science major will have a higher income and pay back versus the philosophy major, or teacher. Income-based repayment is in contrast to other regular debt. Usually, student-loan or other debt is based on a certain amount of principal (the amount borrowed) and a fixed payment schedule based on the interest rate and the length of the loan. There is no flexiblity in repayment and it is based irrespective to income at any point (unless you default).

So why not? Universities may say that they are not in the banking business or risk assessment business. Why not? They are already discounting students with grants (called financial aid). Why not turn the model into a future funding source for universities to increase fiscal strength and invest in the future of students by helping them to complete their education in a timely manner.

Furthermore, according to the Upstart CEO, funders are motivated to become mentors --- universities should be interested in their students' professional success and provide additional services and mentoring. Give the institution or alumni a financial incentive, since part of the tuition re-payment depends on their direct success.

I strongly supported the idea when the U.S. government introduced income-based repayment of loans. It reduces the burden on the individual, it encourages people to pick careers in which they will succeed as opposed to making career choices purely based on financial reward. As a society, we need social workers, teachers and nurses.

The Upstart model has the added advantage of being a portfolio investment approach, the repayment is limited to 5x the borrowed amount, but the increased repayment by very successful alumni exceeding the initial loan amount will compensate for the losses by certain other alumni. Overall, the university would be able to get a financial return on their loans.

We do have to consider a downside if every university were to convert their current financial grants into income-based repayment; it would lead to increasing the debt burden of students and not decrease it. In order to create a more stable portfolio of income for the universities and to limit the burden for students, universities could limit the availability to the junior and senior years of undergraduate programs, and require a certain GPA to be maintained. Graduate programs would not have that limit. Universities could theoretically consider making cash loans to alumni that want to start companies or take lower paying positions to get certain experiences, etc. --it would be the model of Upstart. This would require a cash amount as opposed to using the opportunity cost of receiving tuition.

While there all types of regulatory questions to be considered, currently only accredited investors are permitted to make these loans. The Security and Exchange commission defines an accredited investor as a person with an income over $300k or a net worth over $1m. The thought is that this individual can absorb and assess the risk of such unregulated financial investments. The legal environment is still adjusting to the newly created crowd funding systems, such as Kickstarter and several others.

The easiest way to get a university started with this funding could be established via alumni associations. Alumni with the right financial credentials would be backing current students or young alumni. They could even pledge the repayments and returns to fund future programs of that type or the univesity efforts.

Investing into the future of students, while enhancing the viability of a university seems like a worthwhile project to try.